EPFO

If you want to know almost all the information related to epfo portal like – Login, Member Passbook, UAN Login, Check PF Claim Status, File Complaint, Check EPF Passbook, Activate UAN Number etc., you will get to know in this blog.

The Employees’ Provident Fund Organisation (EPFO) in India, established by the Ministry of Labour and Employment on March 4, 1952, offers retirement, insurance, and provident fund services to employees in non-governmental organisations.

Managing accounts for over 27.74 crore individuals, it ensures financial security post-retirement.

This article covers key aspects of EPFO Portal and UAN login processes, essential for employees seeking to access their EPF accounts and benefits.

Okay, here’s a quick look at the EPFO portal in a short table format:

EPFO Login & Status Check

| Feature/Service | Description |

| UAN Activation | Get your unique retirement account number up and running. |

| Check PF Balance | See how much money is in your Provident Fund account. |

| Download Passbook | Get a statement of your PF contributions and interest. |

| Online Claims | Apply to withdraw or get an advance from your PF online. |

| Update KYC | Link important documents like Aadhaar and PAN to your account. |

| Transfer PF Account | Move your PF savings when you change jobs. |

| Track Claim Status | See the progress of your withdrawal or transfer request. |

| Register Grievance | Lodge a complaint if you have an issue with your PF. |

| View Service History | See details about your past employment and contributions. |

| Official Website | https://www.epfindia.gov.in/ |

Contents

- 1 EPFO

- 2 EPFO Login & UAN Login Process

- 3 Online Process for Checking EPFO Passbook, Claim Status, and Balance

- 4 Universal Account Number (UAN) Explained

- 5 Overview of the Employees’ Provident Fund Organisation (EPFO)

- 6 Objectives of EPFO

- 7 Benefits of EPFO

- 8 Schemes Related to EPFO

- 9 Eligibility to Get the Benefits of EPFO Schemes

- 10 Conclusion

- 11 FAQ’s

EPFO Login & UAN Login Process

Any person who has obtained their UAN number and password and wants to UAN Member Login, can follow the simple process outlined below on the official EPFO website:

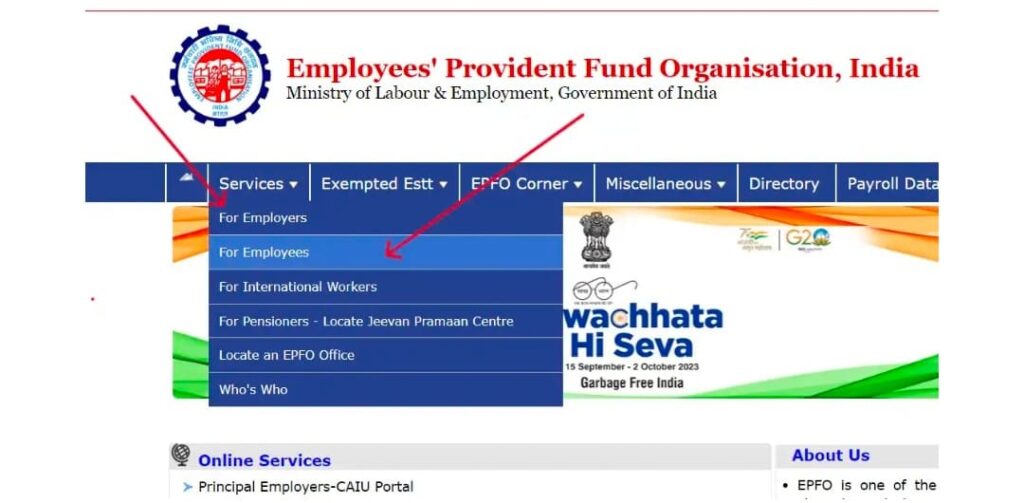

1.First, visit the official EPFO website at https://www.epfindia.gov.in/.

2.On the homepage, in the top menu bar, click on the “Services” option.

Upon clicking this option, you will see a total of 6 options, which are as follows:

• For Employers: If you are an employer and wish to avail SERVICES related to this, click on this EPFO Employer Login option.

• For Employees: If you are an employee and want to perform EPFO Login, UAN Login, and access other services, choose this option.

• For International Workers: If you are an employee working in a foreign country and need to access EPFO services, select this option.

• For Pensioners: If you are a pensioner, click on this option to visit the Jeevan Pramaan portal.

• Locate An EPFO Office: By selecting this option, you can find the address of the nearest EPFO office.

To log in to the EPFO UAN Member Portal, you need to click on the “For Employee” option.

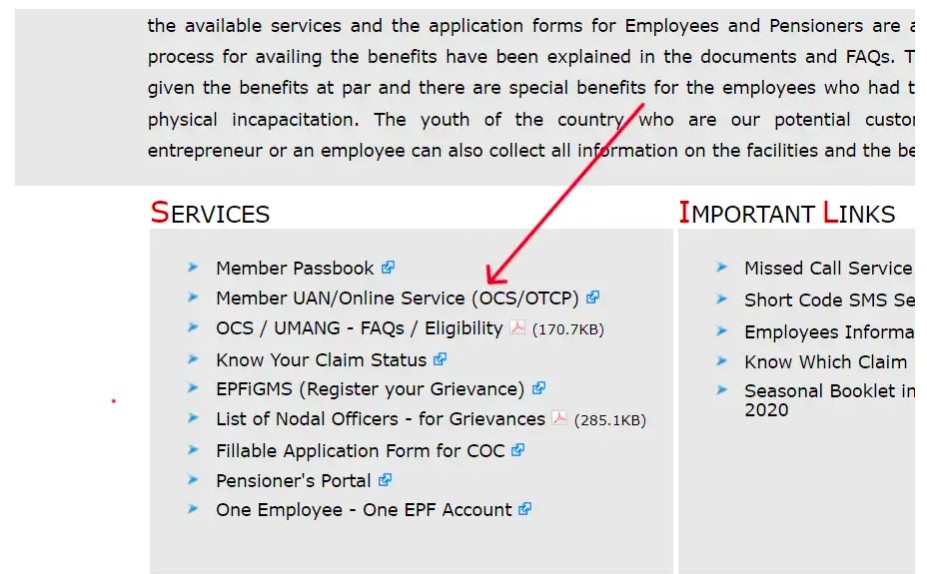

• Thereafter, a page will open. Here, scroll down to the “Services” section.

• Then, click on “Member UAN/Online Service (OCS/OTCP)” in this section.

• Thereafter, the EPFO Member Home page will open.

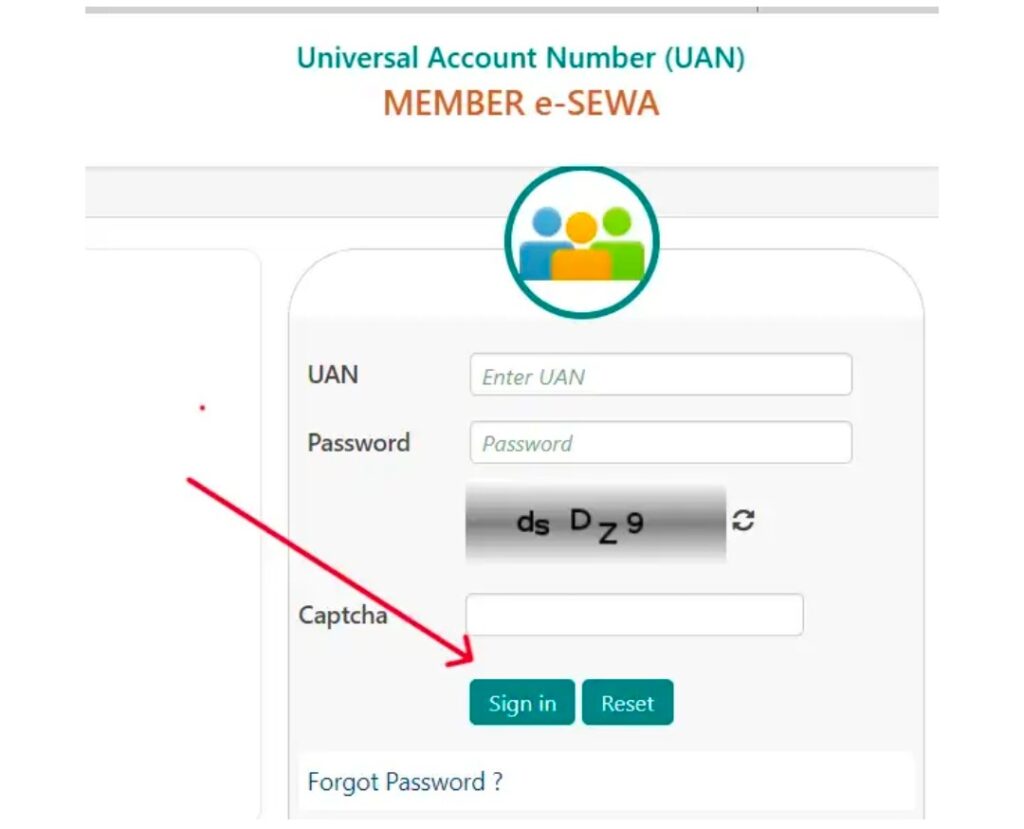

• On the EPFO Member Portal, you will see the “EPFO Universal Account Number Login” box on the right side.

• For EPFO UAN Login, enter your UAN number, password, and captcha in the box provided on the EPFO Member Portal.

• Now, click on “Sign In” to complete the EPFO login.

Your UAN login will be successful, and a new page will open on your screen, displaying the employee’s complete information, including name, UAN number, email, Aadhaar card, and other relevant details, Also you can do EPF withdrawal process here.

Online Process for Checking EPFO Passbook, Claim Status, and Balance

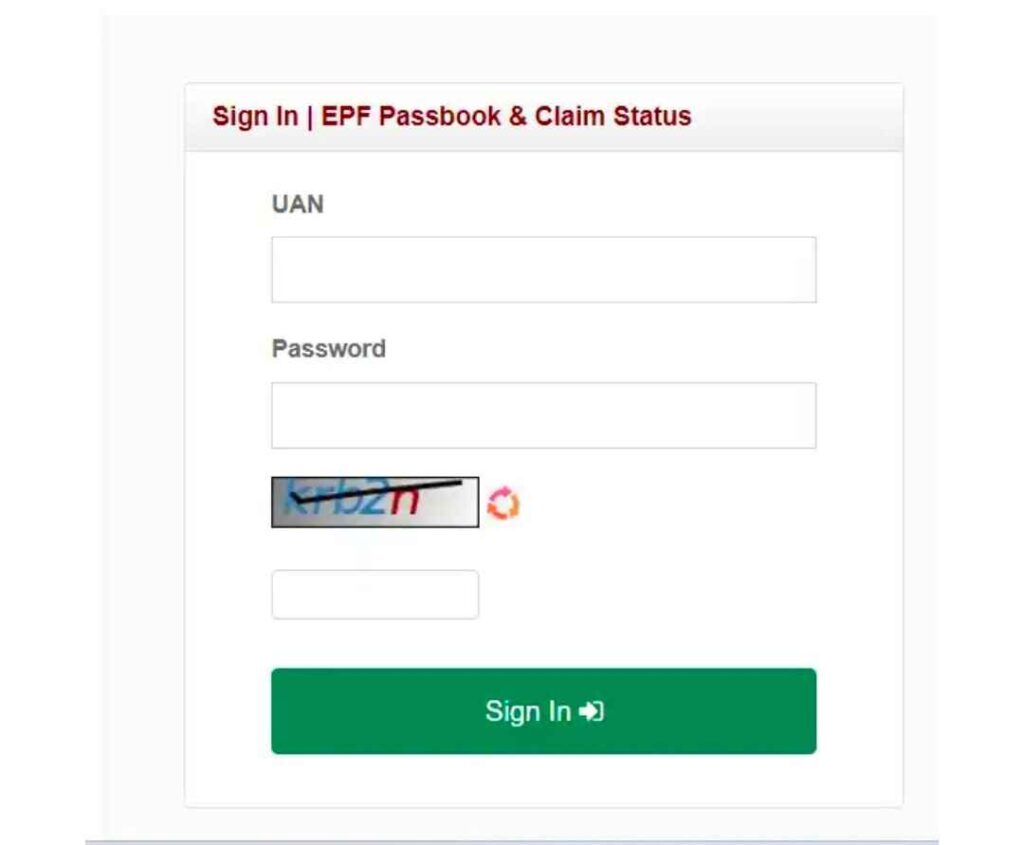

If you want to view your EPF e-Passbook, check your EPF balance, or log in to your Member Passbook, you’ll need to follow the steps below:

• Visit EPF Homepage: Start by going to the EPF website.

• Select “e-Passbook”: Find and click on “e-Passbook” on the homepage.

• Sign In: Enter your UAN, password, and captcha on the Member Passbook page and click “Sign In”.

• Access Passbook: View your EPFO Member Passbook, detailing your transactions, contributions, and interest.

• Check Balance: See your total EPF account balance.

• Manage Claims: Easily submit or track the status of your EPFO claims online.

Universal Account Number (UAN) Explained

Employees who work with various organisations throughout their careers are integrated into the EPF scheme using a unique 12-digit Universal Account Number (UAN) assigned by the EPFO.

This UAN remains constant, facilitating access to EPF benefits and enabling the management of EPF-related tasks across different employers.

Overview of the Employees’ Provident Fund Organisation (EPFO)

The Employees’ Provident Fund Organisation (EPFO), under the Indian Ministry of Labour and Employment, manages EPF, insurance, and pension schemes for employees across India.

It’s the world’s largest social security organisation, serving over 27.74 crore individuals through 138 offices nationwide, making it the largest active organisation globally.

Objectives of EPFO

The main goal of the Employees’ Provident Fund Organisation (EPFO) is to offer social security to non-government employees in India, ensuring their well-being.

It also seeks to enhance transparency in financial transactions, modernize operations, and make them paperless.

The EPFO envisions an efficient, technology-driven social security system accessible to across India.

Benefits of EPFO

Here are the benefits provided by the Employees’ Provident Fund Organisation (EPFO) in steps:

1.Social Security: EPFO offers social security to all employees in India.

2.Insurance Scheme: Employees are automatically enrolled in an insurance scheme through the EPFO.

3.Pension Scheme: Interested employees can connect to a pension scheme through the EPFO.

4.Employee Provident Fund (EPF) Scheme: EPFO links employees to the EPF scheme for their future financial security.

5.Health Insurance: EPFO provides health insurance facilities to the family members of all its beneficiaries.

6.Medical Facilities and Compensation: In the event of any mishap with account holders, the EPFO provides them with medical facilities and compensation for their losses.

7.Retirement Benefits: After retirement, employees can avail of the pension facility as per their preference.

Schemes Related to EPFO

EPFO offers three main schemes to its account holders:

1.Employee Provident Fund (EPF) Scheme: EPFO links employees to EPF, with a 12% deduction from the salary, matched by the employer. The funds earn interest, and employees can withdraw them with interest upon retirement or for specific purposes like marriage, education, illness, or home construction.

2.Insurance Scheme: EPFO enrolls employees and their families in an insurance scheme. It covers medical expenses in case of accidents involving family members and provides a lump sum payment of up to 20 times the salary amount (up to 6 lakh Indian Rupees) if a member passes away while part of the scheme.

3.Pension Scheme: EPFO provides a pension scheme for employees, offering pensions in cases of disability, retirement, or widowhood. It also includes a monthly allowance for the employee’s children.

Eligibility to Get the Benefits of EPFO Schemes

Eligibility Criteria for EPFO Schemes:

1.Age: Employees must be at least 18 years old.

2.Employment: Must be working in an organisation or company.

3.Salary Cap: Applicable to employees earning up to ₹15,000 per month, though higher earners can opt in voluntarily.

4.Pension Scheme: Requires at least 10 years of service for eligibility.

5.Nationality: Must be an Indian citizen.

6.International Workers: Indian employees abroad are eligible.

7.Company Registration: Employees should be registered with their employing organisation.

Also Read

Parivahan Sewa Application Status

ABC ID and Digilocker Login Process

Conclusion

In summary, the Employees’ Provident Fund Organisation (EPFO) provides crucial financial safety nets for Indian employees, including provident fund, insurance, and pension schemes.

Its eligibility criteria, encompassing age, employment status, salary, and citizenship, enable a broad spectrum of individuals to benefit from these important services.

FAQ’s

1. What is a UAN and why do I need it?

Think of UAN (Universal Account Number) as your unique retirement account number, like a roll number in school. It’s a 12-digit number that stays with you throughout your career, linking all your different job PF accounts in one place. You need it to access most online EPFO services.

2. How can I activate my UAN?

You can easily activate your UAN on the EPFO member portal. You’ll need your UAN, mobile number, and your PF member ID from your employer. Just follow the simple steps online!

3. How can I check my PF balance?

Checking your PF balance is super easy! You can do it online through the EPFO member portal by logging in with your UAN and password, or even through the UMANG app. You can also give a missed call or send an SMS to the designated EPFO numbers from your registered mobile number.

4. How do I download my PF passbook?

Your PF passbook is like a mini-statement of your PF account. You can download it from the EPFO member portal after logging in with your UAN. It shows your and your employer’s contributions and the interest earned.

5. Can I withdraw money from my PF account online?

Yes, absolutely! If you meet certain conditions (like unemployment for a specific period or for specific needs like medical emergencies), you can submit a withdrawal claim online through the EPFO portal using your UAN.

6. How can I update my Aadhar or other details (KYC) in my PF account?

You can update your Know Your Customer (KYC) details like Aadhaar, PAN, and bank account on the EPFO member portal under the ‘Manage’ section. You’ll need to upload scanned copies of your documents, and your employer will need to approve them online.

7. How do I transfer my PF account when I change jobs?

Transferring your PF from your old job to your new one is now much simpler online. You can initiate the transfer request through the EPFO portal using your UAN. This helps consolidate your PF savings.

8. How can I check the status of my PF withdrawal or transfer claim?

You don’t need to visit an office to check your claim status. Just log in to the EPFO member portal and go to the ‘Online Services’ section, where you can track the progress of your submitted claim.

9. What should I do if I have a problem or complaint regarding my PF account?

If you face any issues, you can register a grievance online through the EPF i-Grievance Management System portal. You can also track the status of your complaint there.

10. Is it mandatory to link my Aadhaar with my UAN?

Yes, linking your Aadhaar with your UAN is very important. It’s a key requirement for accessing online services,スムーズな transactions, and ensuring the security of your PF account.

EPFO login,EPFO member login,EPFO passbook,UAN login EPFO online claim,EPFO member home,EPFO member login,UAN Member login,EPFO employer login,EPFO login passbook,EPFO home,EPFO Member portal