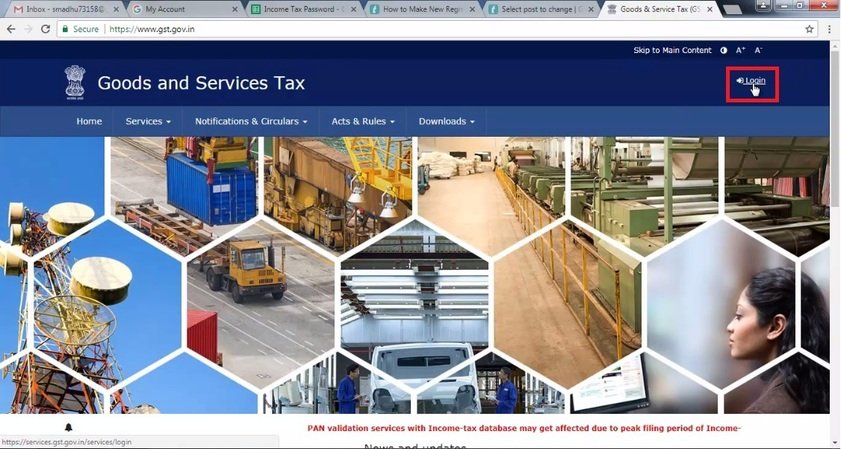

GST Login

The Goods and Services Tax (GST) is arguably the most significant indirect tax reform in India’s history, marking a monumental step towards creating a ‘One Nation, One Tax’ system. Effective from July 1, 2017, GST replaced a complex web of central and state indirect taxes—like Excise Duty, Service Tax, VAT, and CST—into a single, unified tax. At its core, GST is a comprehensive, multi-stage, destination-based tax levied on every supply of goods and services.

Being ‘destination-based’ means the tax accrues to the state where the goods or services are consumed, not where they are produced (unlike the old taxes). Its main design goal was to eliminate the “cascading effect” (tax on tax), as businesses can claim Input Tax Credit (ITC) for taxes paid on purchases, ensuring that only the value addition at each stage is taxed. This simplification aims to streamline compliance, boost economic growth, and make Indian products more competitive globally.

GST Login & Registration

| Feature | Description |

|---|---|

| Full Form | Goods and Services Tax |

| Nature | Multi-stage, Destination-Based Consumption Tax |

| Key Principle | “One Nation, One Tax” – Replaced many Central and State indirect taxes. |

| Benefit | Eliminates the Cascading Effect (tax on tax) through Input Tax Credit (ITC). |

| Constitutional Basis | Constitution (101st Amendment) Act, 2016 |

Contents

Components of the Dual GST Structure

India’s GST model is dual, meaning both the Central Government and the State Governments simultaneously levy tax on the same transaction. This structure ensures revenue sharing for both levels of government.

1. Central Goods and Services Tax (CGST): This is the tax levied by the Central Government on intra-state (within the same state) supply of goods and services.

2. State Goods and Services Tax (SGST): This is the tax levied by the State Government on intra-state supply of goods and services. The revenue goes to the respective state.

3. Integrated Goods and Services Tax (IGST): This is levied by the Central Government on inter-state (one state to another) supply of goods and services, as well as on imports. The IGST revenue is then shared between the Centre and the destination State.

4. Union Territory Goods and Services Tax (UTGST): This is the equivalent of SGST, levied on intra-union territory supply of goods and services in Union Territories without a legislature (like Andaman & Nicobar, Lakshadweep, etc.).

GST Tax Slabs (Rates)

To ensure different goods and services are taxed according to their nature and necessity, the GST framework uses multiple tax slabs. While rates can change based on the recommendations of the GST Council, the primary slab rates are generally:

- Exempt (0%): Essential items like food grains, milk, fresh vegetables, etc.

- Lower Rates (5%): Items of mass consumption, like packaged food, spices, tea, and some essential services.

- Standard Rates (12% and 18%): Most processed goods and services fall under these two standard rates.

- Highest Rate (28%): Luxury and ‘sin’ goods (like high-end automobiles, tobacco products, and aerated drinks), which also attract a Compensation Cess over the 28% rate.

Benefits and Challenges of GST

Benefits (Pros)

- Cascading Effect Removal: The biggest benefit is the elimination of ‘tax on tax’ through the seamless flow of Input Tax Credit (ITC), reducing the final cost for the consumer.

- Common National Market: GST removed state borders for tax purposes, allowing for easier, faster, and cheaper movement of goods across India (improving logistics).

- Simplified Compliance: Replacing multiple forms and processes with a single online portal (GSTN – Goods and Services Tax Network) for registration, returns, and payments.

- Wider Tax Base: By bringing more businesses into the tax net and reducing the previous threshold for exemption, the overall tax base has expanded.

Challenges (Cons)

- Compliance Complexity for SMEs: Small and medium enterprises (SMEs) often find the periodic filing requirements and documentation to be burdensome, despite the online system.

- Technology Dependence: The system relies heavily on the smooth functioning of the GSTN portal, and technical glitches can occasionally hamper compliance.

- Frequent Rule Changes: Businesses sometimes struggle to keep up with the continuous updates and clarifications issued by the GST Council.

- High Rates for Certain Products: Some essential services or products might have seen a marginal price increase due to being moved to a higher tax bracket under the new structure.

FAQ’s

What is the full form of GST and what kind of tax is it?

The full form is Goods and Services Tax. It is an indirect tax and a destination-based consumption tax, meaning it’s paid by the end consumer and collected at the point of consumption.

Which ancient Indian taxes were replaced by GST?

GST replaced approximately 17 major indirect taxes at the Central and State levels, including Central Excise Duty, Service Tax, Value Added Tax (VAT), Central Sales Tax (CST), Octroi, and Entertainment Tax.

What is Input Tax Credit (ITC) and why is it important?

ITC is the credit a business receives for the GST paid on its purchases (inputs). It’s crucial because it allows the business to deduct this tax amount from the GST it collects on its sales (output), thereby ensuring that tax is levied only on the value addition made by the business.

Which products are currently kept outside the purview of GST?

The most significant exclusions are Alcoholic liquor for human consumption and five petroleum products (crude oil, petrol, diesel, natural gas, and aviation turbine fuel), which continue to be taxed under the old tax regime (VAT/Sales Tax and Excise Duty).

What is the GST Council?

The GST Council is a constitutional body that makes recommendations to the Union and State Governments on all matters relating to GST, including tax rates, rules, and exemptions. It is chaired by the Union Finance Minister and includes State Finance Ministers as members.

Would you like to know more about the process for GST registration or the current tax rates for a specific product or service?

GST ,GST Login,Express GST,GST portal,GST login search,Www GST gov in login dashboard,GST login ID,GST login PAN card